To turn an old phrase around, the less things change the more they get drastically different.

If you’ve been paying attention, the signs are there. Much in the same way Westworld sprinkled little things here and there that looked really obvious once the suspense played out, the dots are there to be connected.

There was talk that the Aquilini family was getting more involved with the team.

There were musings linking Dale Tallon to the Canucks.

There were heated trade talks that came to a sudden halt.

Now there’s a report that the Canucks won’t ask anyone to waive a No Trade or No Move Clause.

And even more telling, outright reports that the Canucks front office, who were busy shopping for 20-goal scorers just a couple of weeks ago, no longer have trade-making authority.

Let that sink in.

Not only can’t the General Manager make a trade, even the team President doesn’t have that authority. It has to go back to ownership for approval.

And in a hilarious development, it appears that the front office are trying to spin the sudden freeze on trade talks as a sign that the rebuild is finished. That they’ve made all the changes that need to be made to get this franchise back on the right track.

To take another crack at that old phrase, the less things change, the more they stay insane:

But they can’t spin everything away.

There are even whispers that ownership has consulted with a former NHL GM, who happens to still be under contract with his former team. Not about taking on a GM role with the team, but for advice.

The jig. It is up.

You know that when ownership gets this involved, it’s no longer the on-ice product that’s the issue. The team continues to bleed money.

And while their actually cash payroll (as opposed to AAV used to comply with the salary cap) is on the order of $75 million for this season, ticket sales are the worst they’ve been in almost 20 years. Attendance has is creeping downward, from 98.9% in 2014/15 (10th in the league) to 96.4% to start this season (16th). Season ticket renewals dropped down to 80% this past year, and when renewal notices go out after another disastrous season next spring, it’s going to be much, much worse.

In fact, if the stats Matt Sekeres dropped last night are to be believed, the situation may be even more drastic already:

Even the secondary market, which actually supports the season ticket base as many season ticket holders don’t have the time or can’t afford to attend 41 home games, has taken a tumble. Average prices on the secondary market have plummeted by more than 55% over the last three years, from just under $300 in 2014 to $130 to start this season.

But hey, nobody saw this coming:

The organization as a whole is still making money because they own the arena and control the concessions, but gate receipts are stagnating and Forbes estimates that the value of the franchise has plunged 12.5% from US$800 million in 2014 to US$700 million this year. Now, you might think the drop in the Canada-US exchange rate makes that a wash, but that’s only if you ignore that the exchange rate is outside your control and that the franchise would have been worth that much more in C$ today if it had held it’s US$800 million value.

And yes, the value of the franchise has appreciated considerably since they bought it. But you don’t get that rich by just shrugging off paper losses. In the absence of any other valuation, they’ve taken a US$100 million hit over the last three years. But it’s still a US$700 million asset, and although it is profitable on the whole, Forbes estimates last year’s operating income was just under US$30 million. That’s a 4.2% return on asset value and if the debt ratio is correct at 11%, a 4.8% return on equity.

Those might look like good returns to you and I, but I can guarantee you high net worth individuals would not be willing to tie up that much capital in an asset with such low returns.

So where does this leave us, and what does it have to do with the vague rumours and innuendo I started with?

Well, it comes down to this.

The business is suffering, and the Aquilinis are first and foremost businessmen.

One other rumour that has been circulating for at least a year is that the family is looking for a buyer. In many ways, this has always been a real estate play for the Aquilinis. The second of three existing building sites around the arena is close to completion and the third has planning approval. Pending city approval, there’s potentially a fourth site on the Roger Neilson Plaza at the northeast corner once the Dunsmuir viaduct comes down. Once that approval is given and a develoment permit is issued, the Aquilinis would have one less reason to want to hang on to a declining asset.

But until that point, they need to protect the value of that asset. That means taking a step back and assessing the state of the organization (Weisbrod should have a good idea of what this is like; just picture him sitting across the table from Brian Burke in that clip). Maybe even asking the advice of a former NHL GM for their advice. It means stepping in and taking control of key decisions that might have implications beyond day-to-day operations. Like say, trading players. Maybe even signing contract extensions.

That’s not to say that those things can’t happen, it’s just that they can’t happen without ownership oversight.

The kind of freeze on senior management activities and consolidation of control and authority that is apparently under way in the Canucks organization is exactly what you would if you were considering making a change in direction. But unlike a regular business, where you might have a deeper organization with experieced lower level managers or where ownership might have some experience in the industry and be able to step into a caretaker role, it’s not often you have that situation in an NHL franchise.

So while we may be entering the final act in this play that has been part comedy, part tragedy, it’s likely we won’t see the climax and denouement for a few months yet. Most likely following the end of the season.

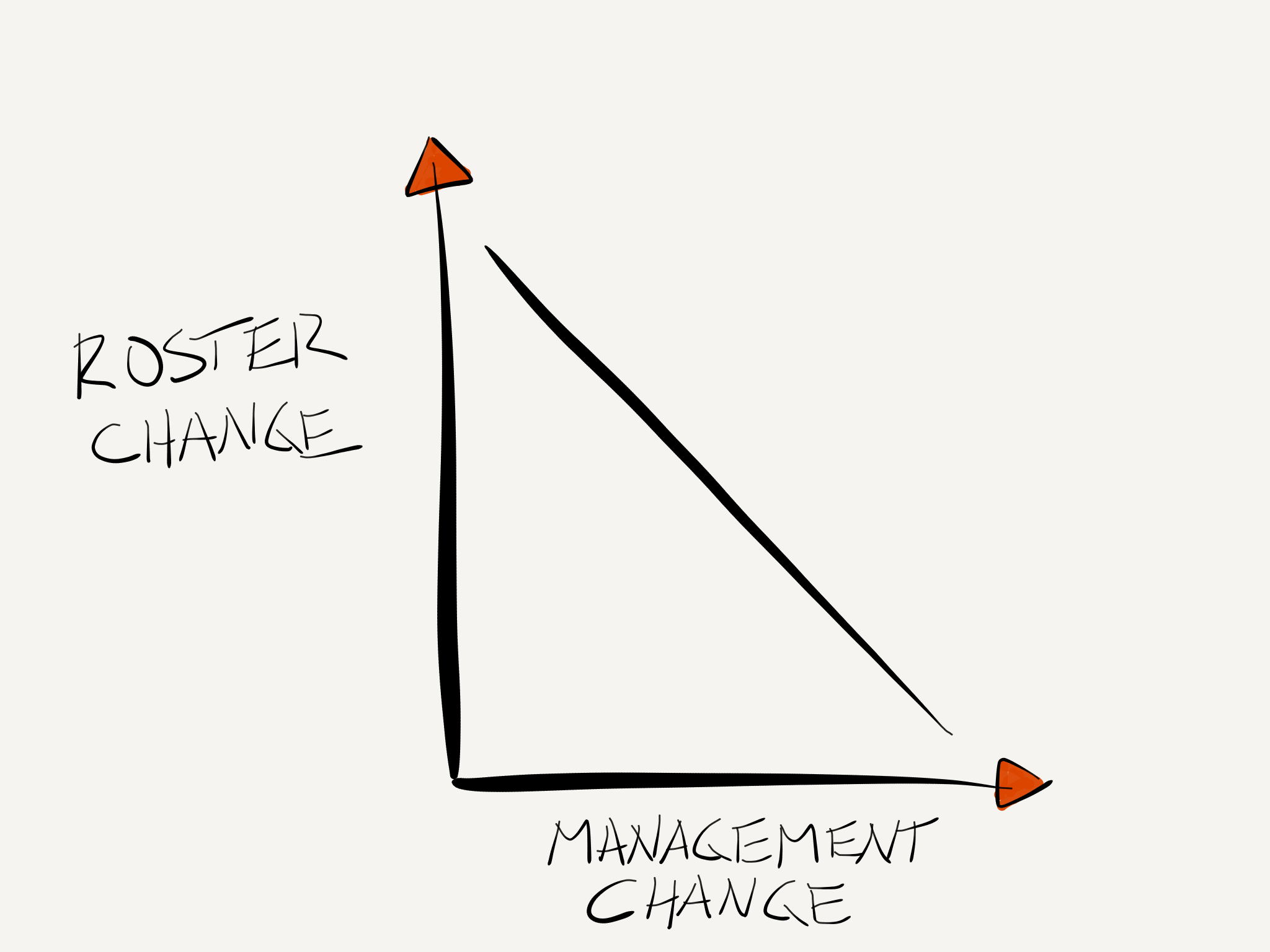

But no matter the timing, if you’re paying attention, the portents of change are there. And if you’ve ever experienced this in a business setting, you’ll know that change management is an important part of setting a new direction. Or in this case, a management change.

I just hope when this is all over, they let Jim Benning keep his stapler.