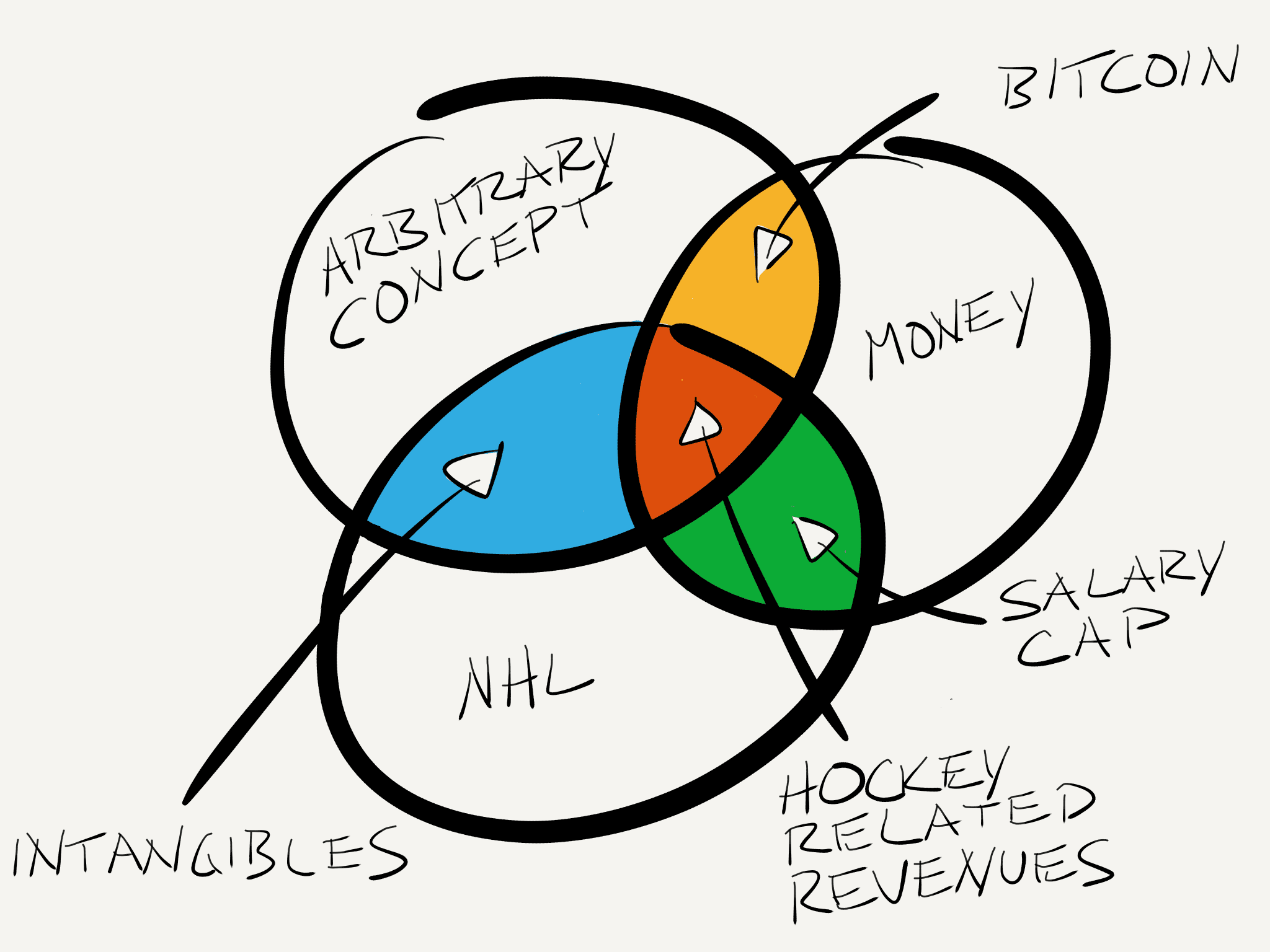

H Is For Hockey Related Revenues

6 years ago

Recent articles from Graphic Comments

Breaking News

- Talking Rick Tocchet’s undeniable impact and Jack Adams Award case: Canucks Conversation

- Vancouver Canucks sign Vasily Podkolzin to two-year contract extension

- What the Vancouver Canucks can expect from the Nashville Predators in round one

- Canucks fans voted JT Miller as team MVP, but did Quinn Hughes deserve it?

- Vancouver Canucks to face Nashville Predators in first round of 2024 Stanley Cup Playoffs