Jason Demers and Tax Rates

6 years ago

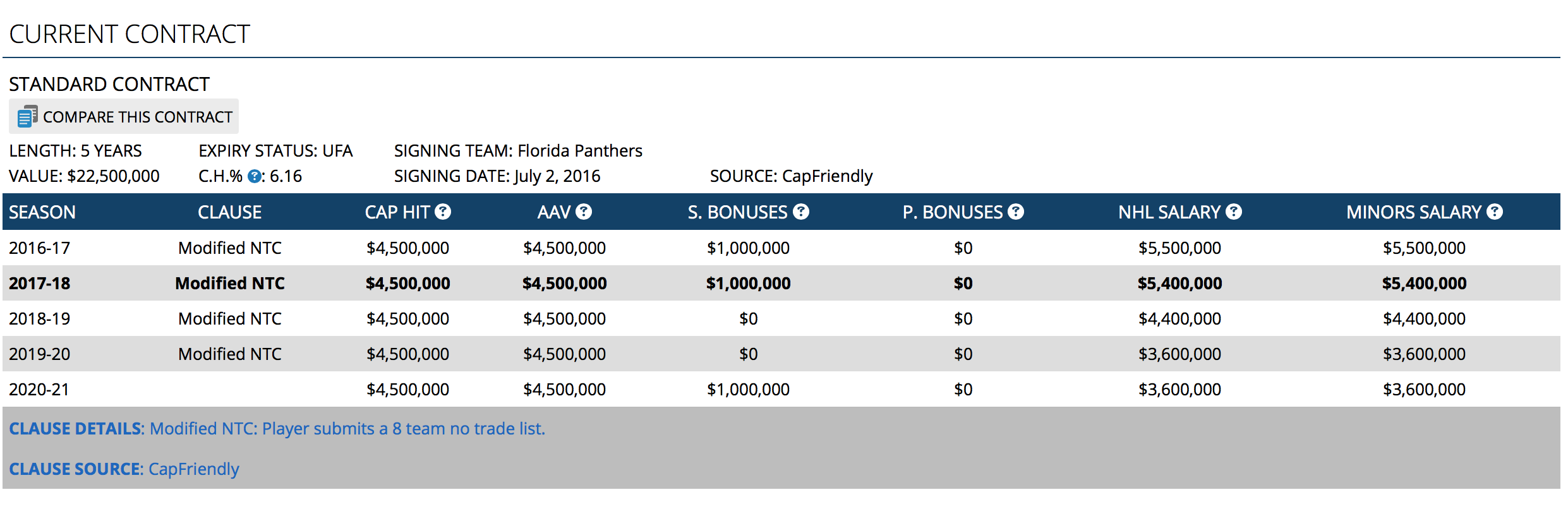

Late last month, the Canucks were rumoured to have a deal in place that would’ve sent Erik Gudbranson to the Florida Panthers for Jason Demers. That transaction never occurred, because Demers invoked his limited no-trade clause which allows him to block a move to eight teams of his choosing.

Demers earned that no-trade-clause by virtue of being a free agent, and he was well within his right to do exercise that option.

We’ve yet to hear why he declined a move to the Canucks, so we are left to speculate the reasons why. Could be the direction of the team, his affinity for Florida or Demers just didn’t want to move again after just the one year in Florida. As usual, though, the wheels started turning.

I was left trying to figure out a possible reason — or uncover some part of the picture — to explain why Demers vetoed a trade to Vancouver. Barring a follow-up report from the NHL’s insiders, I’ll never know what the final reason was for his decision. That’s never stopped me from diving down the rabbit hole, though.

My attention turned to tax rates on the player’s salaries, and I quickly noticed that the financial impact to Demers would’ve been noteworthy. Thankfully, www.CapFriendly.com has all this information readily available.

*These are all just estimates, I am not a tax lawyer nor do I have all the information. All data is from Capfriendly.com*

Jason Demers carries a cap hit of $4.5-million next season but is actually scheduled to receive $5.4-million for the 2017-18 season. That includes a $1-million signing bonus that was paid out on July 1st and may have been part of the reason why the Panthers wanted were motivated to move him before the pay-out. They were unable to move him in time, and then quickly bought out Jussi Jokinen.

With the $5.4-million salary in consideration here, I pulled the information from CapFriendly about the tax rates for each team and came out with this.

| Team | Federal Rate | State Rate | City Rate | Estimated Tax Rate |

| Anaheim Ducks | 38.79% | 12.87% | – | 51.66% |

| Arizona Coyotes | 38.79% | 4.52% | – | 43.31% |

| Boston Bruins | 38.79% | 5.10% | – | 43.89% |

| Buffalo Sabres | 38.79% | 8.42% | – | 47.21% |

| Calgary Flames | – | – | – | 47.47% |

| Carolina Hurricanes | 38.79% | 5.75% | – | 44.54% |

| Chicago Blackhawks | 38.79% | 3.75% | – | 42.54% |

| Colorado Avalanche | 38.79% | 4.63% | – | 43.42% |

| Columbus Blue Jackets | 38.79% | 4.95% | 2.50% | 46.24% |

| Dallas Stars | 38.79% | – | – | 38.79% |

| Detroit Red Wings | 38.79% | 4.25% | 2.40% | 45.44% |

| Edmonton Oilers | – | – | – | 47.47% |

| Florida Panthers | 38.79% | – | – | 38.79% |

| Los Angeles Kings | 38.79% | 12.87% | – | 51.66% |

| Minnesota Wild | 38.79% | 9.77% | – | 48.56% |

| Montreal Canadiens | – | – | – | 52.88% |

| Nashville Predators | 38.79% | – | – | 38.79% |

| New Jersey Devils | 38.79% | 8.69% | – | 47.48% |

| New York Islanders | 38.79% | 8.42% | – | 47.21% |

| New York Rangers | 38.79% | 8.42% | 4.25% | 51.46% |

| Ottawa Senators | – | – | 52.90% | |

| Philadelphia Flyers | 38.79% | 3.07% | 3.91% | 45.77% |

| Pittsburgh Penguins | 38.79% | 3.07% | 3.00% | 44.86% |

| San Jose Sharks | 38.79% | 12.87% | – | 51.66% |

| St. Louis Blues | 38.79% | 6.00% | 1.00% | 45.78% |

| Tampa Bay Lightning | 38.79% | – | – | 38.79% |

| Toronto Maple Leafs | – | – | – | 52.90% |

| Vancouver Canucks | – | – | – | 47.20% |

| Washington Capitals (D.C.) | 38.79% | 8.56% | – | 47.35% |

| Washington Capitals (Virginia) | 38.79% | 5.75% | – | 44.53% |

| Winnipeg Jets | – | – | – | 49.97% |

The final tax percentages are in the far right column. Since the state of Florida does not have any State income tax, and there isn’t any city income tax in Sunrise, the tax rate is considerably lower than the majority of other teams, including the Canucks. We can compare the two closer together:

| Florida Panthers | 38.79% | – | – | 38.79% |

| Vancouver Canucks | – | – | – | 47.20% |

That is a difference of 8.41% off the $5.4-million that Demers was scheduled to earn this upcoming season. Once again, CapFriendly provides the actual financial impact that would have on Demers wallet:

| Team | Federal Rate | State Rate | City Rate | Estimated Tax Rate | Tax Paid | Net Salary | Difference |

| Florida Panthers | 38.79% | – | – | 38.79% | $2,094,570 | $3,305,430 | – |

| Vancouver Canucks | – | – | – | 47.20% | $2,548,828 | $2,851,172 | (-$454,258) |

If Demers had accepted the trade to the Canucks, it would’ve cost him $454,258 USD this upcoming year. This obviously doesn’t include other deductions such as agent percentages, but that isn’t chump change.

Tax rates change based on your income, and as we saw above, Demers compensation does change from year to year. Thus here is a quick breakdown of the other years remaining on his deal:

2018-19 season

| Team | Estimated Tax Rate | Tax Paid | Net Salary | Difference |

| Florida | 38.60% | $1,698,570 | $2,701,430 | – |

| Vancouver | 47.09% | $2,071,828 | $2,328,172 | (-$373,258) |

2019-20 season

| Team | Estimated Tax Rate | Tax Paid | Net Salary | Difference |

| Florida | 38.38% | $1,381,770 | $2,218,230 | – |

| Vancouver | 46.95% | $1,690,228 | $1,909,772 | (-$308,458) |

2020-21 season

| Team | Estimated Tax Rate | Tax Paid | Net Salary | Difference |

| Florida | 38.38% | $1,381,770 | $2,218,230 | – |

| Vancouver | 46.95% | $1,690,228 | $1,909,772 | (-$308,458) |

Now, when we combine those totals.

| 2017-18 | -$454,258 |

| 2018-19 | -$373,258 |

| 2019-20 | -$308,458 |

| 2020-21 | -$308,458 |

| Total | -$1,444,432 |

The financial impact for Demers to agree to a trade to the Vancouver Canucks before July 1st, 2017 would’ve been $1,444,432. It likely wasn’t the only reason why he didn’t agree to adjust his limited no-trade protection to accept a trade to the Canucks, but you have to believe that it was at the very least brought up by someone.

If the fit was perfect, or the Canucks were on the verge of being a cup contender, someone like Demers might overlook that salary difference. But at this point, the current position of the organization and a variety of factors including the financial impact were all possibly combined to turn down the deal.

It is worth noting that Demers went from Dallas, Texas, which has no State income tax to Florida, which also doesn’t have State income tax.

From a big picture viewpoint, it brings more light to the fact that sometimes it isn’t simply a yes or no. These are people, and all of these factors go into their decisions on where they ply their trade.

It takes two teams to make a trade, but sometimes it takes a player who is also willing to make a sacrifice.