The NHL Board of Governors concluded two days of meetings last week to review a number of issues, including the overall state of the league, and as Dan Rosen reported, business is booming.

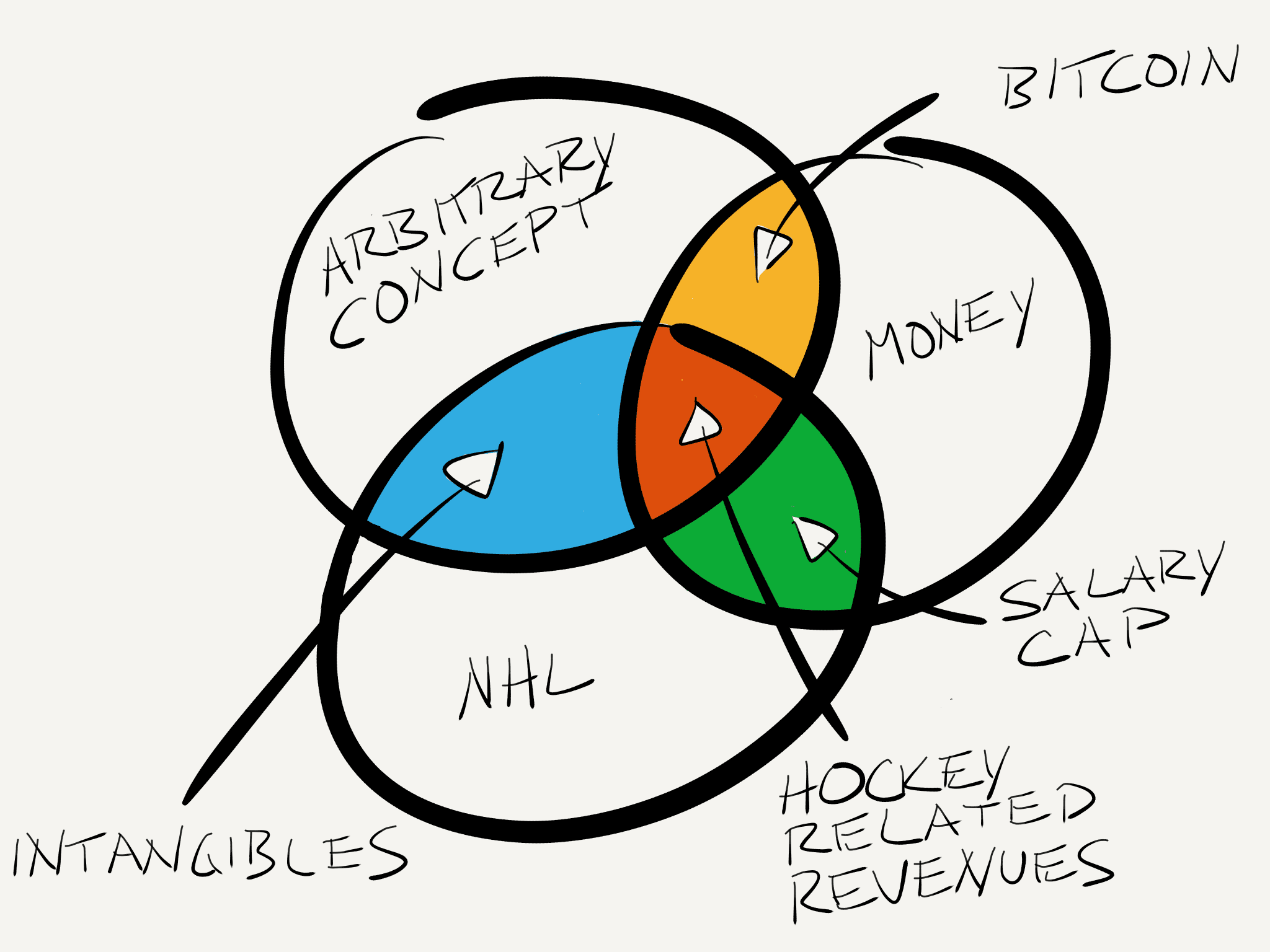

Heck, the only thing increasing faster than NHL revenues is bitcoin.

And just like bitcoin, not only are NHL revenues subject to manipulation by shady characters, only a few ever truly benefit from the increases.

Given that the NHL is a private organization, as are many of its franchises, there is no official public reporting of NHL finances. This certainly makes it difficult to evaluate how well the league or its franchises are doing. However, there are a variety of data sources available, whether from official filings for those teams that are part of a publicly traded company, or from banking, leasing, and other industry-related sources. And as our own Vanessa Jang alluded to last week, Forbes compiles this data every year to come out with their valuation of NHL franchises. This is how they explain the process:

Every team was sent a questionnaire, looking for confirmation on ownership, price paid for team, various stadium information, among other information. Sports bankers were hammered with questions on past and potential deals. Publicly available information, such as leases, credit rating documents and financial statements of arenas were gathered and scrutinized. Lots of phone calls to media rights analysts for the skinny on TV deals.Revenues and operating income (earnings before interest, taxes, depreciation and amortization) are for the 2016-17 season and net of revenue sharing and arena debt service. Our income statements include revenue team owners get from non-NHL events at their arena, but do not include the expansion fee from the Knights that was divvied out to the other 30 teams in the league.

There are certainly issues with the estimates Forbes presents. In piecing together a number of official and unofficial sources of information, the Forbes data will certainly include a variety of estimates and assumptions. But at least in compiling them all in one place like this, we can rely on the fact that there will be some consistency in the approach and to the assumptions applied across all the teams. Undoubtedly the values are “wrong”, but I remain confident that (a) they are in the ball park, and (b) any errors in their assumptions will apply across all teams, which means relative differences between them should be reliable. The other benefit of using the Forbes data is that they have been doing this annual valuation since 1999, so these same mitigating factors apply on a year-to-year basis.

That said, you actually won’t be able to find data going all the way back to 1999 on Forbes anymore. But because I took an in-depth look at NHL finances using the Forbes data over at NHL Numbers back during the lockout, I still had everything from 2011 and earlier and have now supplemented with the last six years of Forbes data.

With all those caveats aside, let’s dig into the numbers.

REVENUES

According to Rosen, Gary Bettman expects “hockey-related revenues to grow 8.2% to $4.54 billion this season.” Working that backwards would mean last year’s HRR were on the order of $4.2 billion, compared to the $4.4 billion in total revenues estimated by Forbes. Using this as a reality check, we can see that the Forbes estimates are in the right ball park hockey arena.

So if we now look at revenues over time, how is the NHL doing since putting players and fans alike through another lockout? Well, looks like there was little, if any, damage done to the overall league finances. In the four full seasons under this new CBA, NHL revenues have increased at a rate of $231 million per year:

That’s $60 million per year more than the annual increases under the previous CBA.

Clearly, the NHL owners saw this increase coming, which is why they were willing to forego an entire season, if necessary, to assure themselves a higher cut of those revenues.

PLAYER EXPENSES

Speaking of that higher cut of revenues, here’s what has happened to player costs under the last three CBAs:

And you wonder why we keep having lockouts.

Sure, player costs are still increasing every year, but the rate of increase slows with each new CBA. You can also see the immediate impact of that 24% across the board cut in player salaries that was rammed through during the first lockout.

Say what you want about Gary Bettman, but from the owners’ perspective, he has certainly delivered.

OPERATING INCOMES

Operating income is what is left over from revenues once the player and operating expenses have been spent. Typically this does not include amortization, depreciation, interest or taxes. It also does not include capital costs. For example any investment in upgrading or refurbishing arenas.

Keep in mind that any well-run company with a semi-competent CFO is going to try to use accounting methods to minimize the bottom line as much as possible in order to reduce the tax burden. So there are definitely some accounting tricks that any CFO worth his salt is going to apply to minimize the reported operating income. That being said, we can definitely see some trends in financial results across the three CBAs:

Whether you believe that the league as a whole was losing money in the period leading up to the first lockout is up to you. But it is clear that relatively speaking, the NHL is doing much better now than it was then. In particular, total operating income as doubled under this new CBA as compared to the previous one.

Again, if you were wondering why many people see another lockout as inevitable, you need look no further than this chart.

Finally, putting those three elements together, here’s the overview of NHL finances over the last 18 years:

Here, operating costs are estimated as well. Forbes does not report operating costs explicitly, but since Revenue – (Player Expenses + Operating Expenses) = Operating Income, some simple math allows us to calculate them. Keep in mind, that if there’s any special accounting tricks being used by those aforementioned savvy CFOs, this is where they would show up, but overall they represent the non-player costs of running a hockey a franchise. Everything from the coaching staff, to management salaries, to arena leases and utility costs.

WINNERS AND LOSERS

Looking at all of this, you might think everything is great. And at the macro level, it does appear that way. However, the fatal flaw in the NHL’s business model is that the financial health of the league does not scale down to the individual franchise level. It was true under the previous CBA and it remains true today. You can essentially break the league down into thirds. Last year, the top third racked up a combined $488 million in operating income. The middle third made a respectable $112 million, while the bottom third put up $54 million in losses.

If you look at this over time, here’s how the top five and bottom five teams have fared in terms of cumulative operating income:

So despite all the gains the NHL is seeing as a result of this new CBA and the reduction in player costs down to 50% of hockey related revenues, the teams that were losing money prior to the lockout continue to lose money at pretty much the same rate.

I guess nobody saw it coming:

I’m not sure the two sides could have designed a system more destined to fail at the stated goal of helping the smaller market teams if they had tried to do so intentionally.

In the absence of true revenue sharing among NHL teams, the current financial model will continue to make things worse for small market teams. In fact, as a function of how the salary cap works, especially with respect to the salary floor, an increase in local revenues for the large market teams, will serve to drive up the minimum player costs for the smaller market teams. And that’s not just to stay competitive, that’s to meet the requirements of the ever increasing salary floor.

The thing is, in an even more perverse way, this serves those large market teams very well. Because when this CBA expires, it will allow the NHL to trot out the finances of five or six teams once again to show how they are bleeding red ink, and to use that as justification to extract more concessions from the players.

But until the structural problems in the NHL’s revenue-sharing model are fixed, this issue will never be resolved.

FINAL THOUGHTS

Let me just finish with a couple of observations.

First, the Calgary Flames were in the news again this week after it was reported that Gary Bettman met with Houston billionaire Tilman Fertitta, owner of the NBA’s Houston Rockets. This, of course, prompted the water carriers for Flames’ ownership in the local media to raise the alarm over the possible sale of the team to Fertitta.

Having lost the political battle to gift the Flames’ billionaire owners most of the capital to build a new stadium, it appears that the strategy has now turned to scare tactics. B, it turns out, is also for bullshit.

Anyway, while the Flames may have been barely breaking even under the previous CBA, they appear to be doing well under the current agreement and have generated almost $100 million operating profits over the last five seasons:

You would think this might be reason enough to keep the team in Calgary, and you would be right.

This is nothing but a ploy to try to gain leverage over the negotiations with the City of Calgary. It’s the same strategy Daryl Katz, the owner of the Oilers, used in extorting exorbitant subsidies for a new stadium from the City of Edmonton.

So I fully expect the Flames to remain exactly where they are, no matter what the billionaire owners’ stenographers in the local media might say.

Finally, given this is a Canucks blog, here the overview of how the local team has fared under the three CBAs:

Clearly, the issues with falling season ticket renewals and lagging attendance have had an impact on overall revenues. That’s not the only impact, however. The fall of the Canadian dollar down to 70-80 US cents also hurts the bottom line.

But overall, the team remains profitable, and revenues will need to stagnate quite a bit more before the team falls into the red.