Nation Sites

The Nation Network

CanucksArmy has no direct affiliation to the Vancouver Canucks, Canucks Sports & Entertainment, NHL, or NHLPA

The Canucks are in a salary cap crunch, so how can it be fixed? Four solutions examined

Photo credit: © Stephen Brashear-USA TODAY Sports

For a team that has made the playoffs just once in the past seven years, the Canucks have an awful number of inefficient contracts on its books.

And the most painful part? This summer could’ve represented a reset for the franchise had they been willing to be patient for just one more year. Instead, the club is stuck with the anchor that is Oliver Ekman-Larsson’s deal, among other overpayments (insert “can we keep it to a ‘thank you Jim'” soundbite here).

With this in mind, the Canucks’ main goal during the offseason should be clearing cap space, which has already been brought up by both Patrik Allvin and Jim Rutherford. There are a number of ways to address the issue; some of which are risky, while others require patience.

So, let’s take a look at how the team can create a cleaner cap sheet.

The money in, money out option

One option that has become increasingly popular recently is swapping inefficient deals. Rutherford himself has made a number of such transactions, like the Patric Hornqvist/Mike Matheson trade.

That deal worked out for both sides, as Hornqvist and Matheson have each revitalized their careers on new teams. However, there are also many examples that haven’t worked, which is what makes this approach so tricky.

In order to see which players could be involved in such deals, let’s first take a look at the contracts that might be seen as being inefficient:

Player | Remaining contract |

Oliver Ekman-Larsson | 5 x $7.26 million |

Tyler Myers | 2 x $6 million |

Tanner Pearson | 2 x $3.25 million |

Jason Dickinson | 2 x $2.65 million |

Tucker Poolman (currently on LTIR, potentially long-term) | 3 x $2.5 million |

Micheal Ferland (LTIR) | 1 x $3.5 million |

The players that seem most applicable to this section are Pearson and Dickinson, and let’s start with the former.

Pearson might be the most contentious name on the list since he’s coming off what might be his best season in Vancouver. Some people might not even consider his contract to be bloated, but this is precisely why he needs to be moved this summer; the Canucks absolutely can’t risk him declining next year and performing the way he did in 2020-21, or worse.

Remember, he produced at a bottom-line rate that season (18 points in 51 games), and even though Pearson bounced back in 2021-22, we can’t expect him to continue being a good middle-six forward when he’s not the most fleet of foot and will be turning 30 in August.

Put another way, Pearson’s current value might be at its highest since he got traded to Vancouver, and he’s still viewed as a neutral asset at best. The Canucks absolutely need to deal him now because it’s foolish to expect an aging player to continue getting better, and Pearson might also net the team a player on a decent — and not inefficient — contract or a mid-late round pick, which is another reason why the club needs to cash in ASAP.

Dickinson, on the other hand, can’t be viewed as anything but a negative asset at this point. He was borderline unplayable at times but is being paid to be a reliable third-line forward, so the Canucks have no option but to receive an equally poor contract in return.

Some might say that it’s better to trade him next year when he only has a year left on his deal, but Dickinson’s base salary actually increases in his final season, which could further dent his value if he struggles again. Another option would be to bite the bullet and ride out his contract, but this should only be considered if the team thinks that he can bounce back. If not, the potential reward of getting back a player who can hopefully perform better in a new situation seems too alluring, especially since it’s hard to be much worse than Dickinson was last year.

The ones that require patience

Two players fit into this category: Myers and Poolman.

Like Pearson, Myers had arguably his best season as a Canuck, but he still isn’t worth a $6 million cap hit (please don’t fire me, Quads). It might be tempting to try and deal him now to maximize his value, but the team could likely get something better in return if they wait and make a trade next offseason instead.

This is because Myers will only be owed $1 million in salary during the last year of his deal (2023-24), and even if he doesn’t play quite as well next season, such a contract structure could have real value to penny-pinching teams who need to hit the cap floor (see: Senators, Ottawa, and Coyotes, Arizona). Assuming Myers’ play doesn’t fall off a cliff, he might also be able to net the Canucks a late-round pick, so the club doesn’t need to attach assets to get off his deal.

Poolman’s situation is a bit more complicated. He exceeded expectations at the beginning of last year before struggling for a bit, then missed most of the stretch run with head injuries. To state the obvious, there are two ways in which this could go: either Poolman returns and is able to continue playing without further issues, or he stays on LTIR due to recurring issues.

If it’s the former, then all the Canucks can do is assess his play and see if it’s worth exploring a trade. But if Poolman stays on LTIR, then he could uniquely have trade value to contending teams with cap issues much like Ferland, which we’ll touch on shortly.

The only thing that the club can do right now is to wait and see how Poolman progresses over the summer. Let’s all hope for him to make a full recovery.

LTIR shenanigans

This section belongs solely to Ferland, and for good reason. He’s the only player who’s definitively going to be on the Canucks’ LTIR for all of next year, which could strangely provide the team with an attractive trade piece.

Does that sound intuitive? Probably not, but then again, understanding LTIR is almost as tough as understanding the timeline from Back to the Future or Terminator.

See, even though Ferland’s cap hit doesn’t seem to impact the team’s salary cap too much, it actually prevents the club from accumulating daily cap space, which limits their flexibility to no small degree. With that said, another team that is struggling with their cap could see value in acquiring Ferland if it means that they’ll be sending an active player and his respective contract back to the Canucks.

Such a hypothetical deal could prove to be a win-win trade since the opposing team could clear real cap space and use it elsewhere, while the Canucks could acquire a useful player in return and not have to worry about their inability to toll salary cap daily.

This is the main reason why Tampa Bay acquired Brent Seabrook’s retired contract from Chicago last summer in exchange for Tyler Johnson and a second-round pick; it allowed them to get rid of Johnson’s bloated deal from their cap, although it came at the expense of a high pick.

The Canucks don’t need to take back a cap commitment as large as Johnson’s, but they do need to take back something. The good news is that a pick will likely be included in such a deal, and the returning player could be quite useful too, depending on the amount of leverage the opposing team has and how desperate they are.

Potential (future) buyout watch

Last but not least, Ekman-Larsson has a section to himself. It’s fitting, isn’t it? The Canucks were almost out of the woods had they stayed patient for one more season, but the previous Jim just had to pull us back in one last time.

The Swede had a commendable bounceback season, but in order to get off the full freight of his contract, the Canucks likely still need to attach at least a first round pick, among other assets. The more likely route to saving some cap is throughout a buyout, which will still be painful since a portion of his deal will still be on the team’s books for a while.

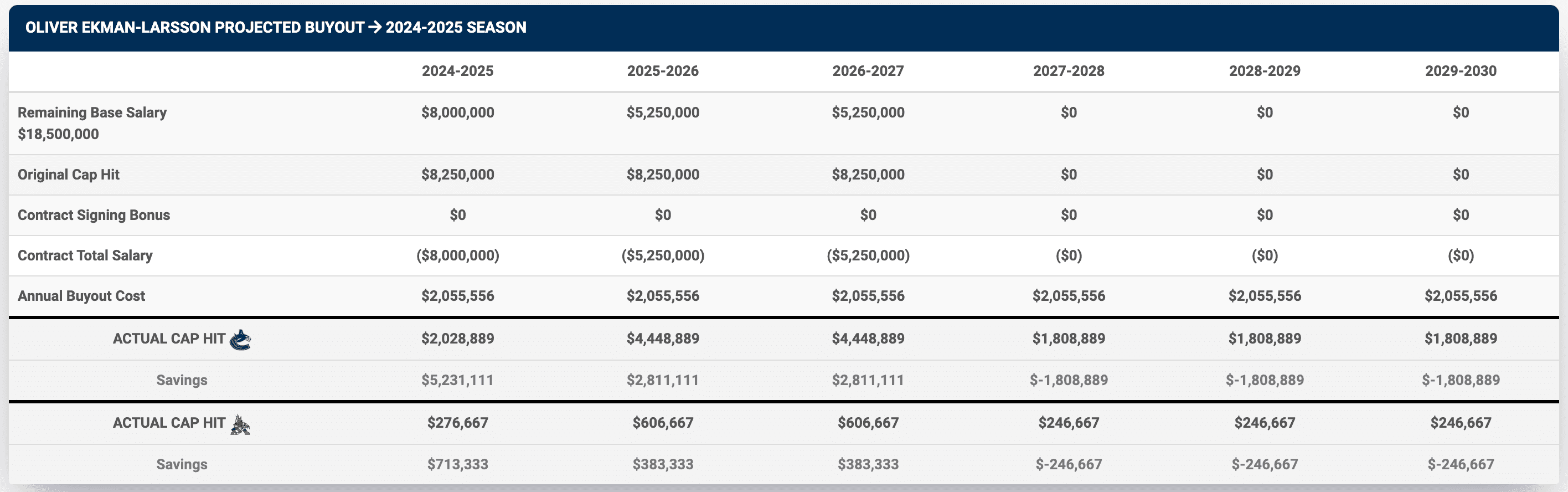

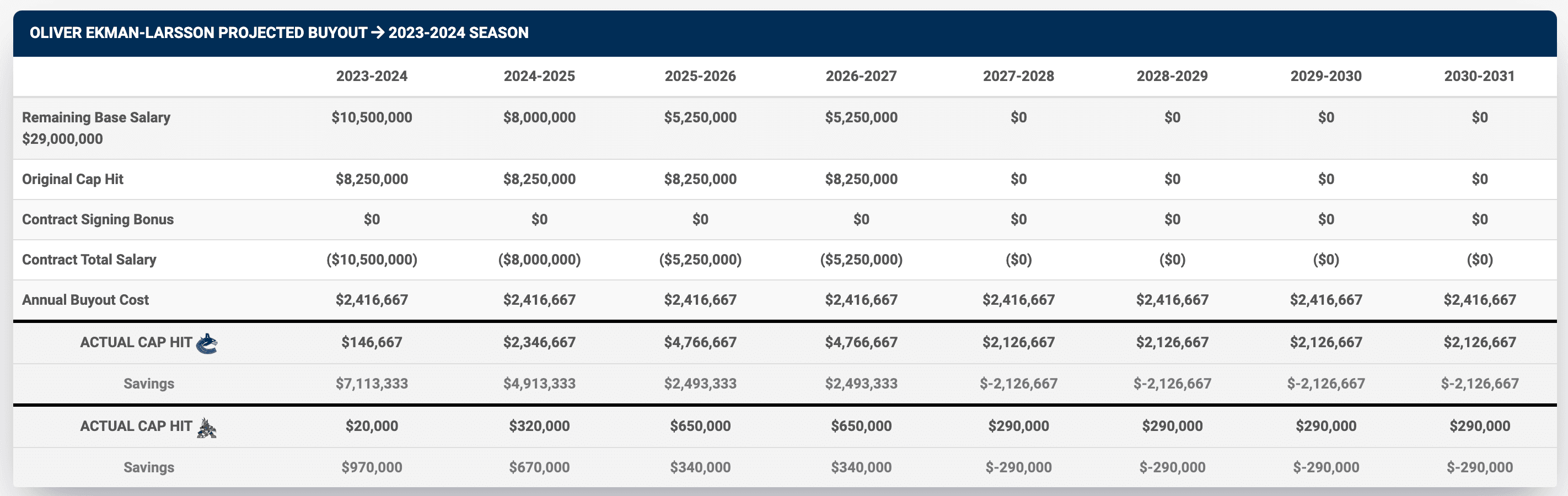

In order to determine when the time is right to execute a potential buyout, there are two things to consider: how much the Canucks will save, and more importantly, when those savings will come in effect. Looking at the team’s current cap sheet, their best window to contend is during the 2024-25 and 2025-26 seasons, which is when many of these inefficient contracts will have expired and both Thatcher Demko and Conor Garland are still signed.

Using those two seasons as a target, it seems like buying out Ekman-Larsson’s deal either next summer or the one after will be the most wise.

Either option would net the Canucks roughly $7.4 million or $8 million in savings during the 2024-26 seasons, which would go a long way in rounding out the rest of the roster. Interestingly, executing a buyout this summer might not be out of the question either since the team would save roughly $7.6 million in those two years along with $7.2 million in 2023-24 too, but the club would be penalized for far longer as well, which isn’t worth it considering they won’t be contending during the next two seasons anyway.

Taking everything into consideration, it makes much more sense for management to consider a buyout in a year or two (and other available options too) if they choose to go down that road.

The Canucks have a number of inefficient contracts, but they can solve their cap issues by maximizing the trade values of certain players and exercising a level of patience. Tanner Pearson and Micheal Ferland could both be moved this summer and return neutral, if not slightly positive assets, but Jason Dickinson will likely only net a similarly poor deal in a potential trade — which could still be worthwhile considering the low risk involved.

Meanwhile, Tucker Poolman’s situation remains unclear due to his nagging migraines, and the team likely needs to hold on to Tyler Myers for one more season before moving him since his actual salary will have dropped significantly by then. Buying out Oliver Ekman-Larsson’s contract could also pay huge dividends, but that will likely need to wait a year or two as well.

No matter how you slice it, the Canucks’ main obstacle right now is their ugly cap situation, which will undoubtedly prove to be the first big test for both Jim Rutherford and Patrick Allvin.

All salary cap info via Puck Pedia.

- The Canucks are in a salary cap crunch, so how can it be fixed? Four solutions examined

- A conversation with Marco Kasper, who is already very close to being an NHLer: Scouting with Faber

- Bruce Boudreau speaks on wanting to learn analytics, his coaching staff, and which Canucks impressed him this past season

Recent articles from Bill Huan

- From Pettersson’s wing to the low minute man: How should the Canucks utilize Andrei Kuzmenko moving forward?

- We watched every one of Bo Horvat’s goals since 2021 to break down his evolution into an elite goal-scorer with the Canucks

- Four Canucks storylines that everyone should be thankful for this Christmas

Breaking News

- The Stanchies: Canucks secure rare home ice win in 2-0 victory over Ducks

- Instant Reaction: Nikita Tolopilo backstops Canucks to 2-0 win over Ducks

- NHL trade rumours: Could the Canucks and Wild strike a deal for Conor Garland?

- Scenes from morning skate: Tolopilo starts, Hronek probable for Canucks vs. Ducks

- What other sellers are the Canucks competing with heading into the roster freeze?